One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs.

Gross Margin vs. Contribution Margin: An Overview

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Management should also use different variations of the CM formula to encumbrances and open balances analyze departments and product lines on a trending basis like the following. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. If the contribution margin is too low, the current price point may need to be reconsidered.

- Business owners generally use the contribution margin ratio on a per-product basis to determine the portion of sales generated that can contribute to fixed costs.

- Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula.

- A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business.

- We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\).

- The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

Analysis and Interpretation

A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\).

Table of Contents

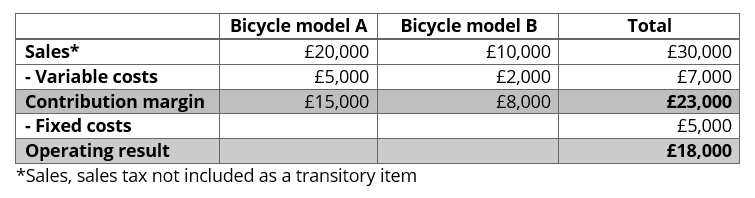

The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. You can calculate the contribution margin for individual products, called unit contribution margin, or for the entire business, which is called total or gross contribution margin.

Does the Contribution Margin Calculation include Services Revenue?

In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better.

The contribution margin and the gross profit margin are both analysis tools used to help businesses increase profits, but they measure different aspects of a business. The former looks at how one product contributes to the company’s profits and the difference between the sales price and variable costs, while the latter looks at overall business profits. The contribution margin excludes fixed costs, whereas the profit margin includes fixed costs. To calculate the gross profit, subtract the cost of goods sold (COGS) from revenue. Contribution margin income statement, the output of the variable costing is useful in making cost-volume-profit decisions.

The break-even point (BEP) is when a business recoups the cost of offering that product or service. Put more simply, a contribution margin tells you how much money every extra sale contributes to your total profits after hitting a specific profitability point. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference.

A low contribution margin or average contribution margin may get your company to break even. The following formula shows how to calculate contribution margin ratio. The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues.

Gross profit margin is the difference between your sales revenue and the cost of goods sold. If you were to manufacture 100 new cups, your total variable cost would be $200. However, you have to remember that you need the $20,000 machine to make all those cups as well. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. To run a company successfully, you need to know everything about your business, including its financials.